Why wait for tomorrow?

A brief selective history, and possibly the latest chapter. Also, 7 other things worth knowing today.

Let's begin today with a very brief and selective history of consumer credit in the United States. Trust me, I think it will be more entertaining than it sounds.

In the beginning—well, let's say in the 19th century—individual consumers could get credit mainly in two ways, beyond friends and family:

Direct relationships with merchants—say, the local grocer. I think there was a Little House on the Prairie episode about this.

Via very specialized institutions, like short-term mortgages with balloon payments through your local building and loan. For a vivid illustration, watch It's a Wonderful Life.

Into the 20th century, with mass industrialization, companies started to think of other options.

For example, the Ford Motor Company rolled out something called “the Ford Plan,” which invited customers to reserve a car and pay for it over time.

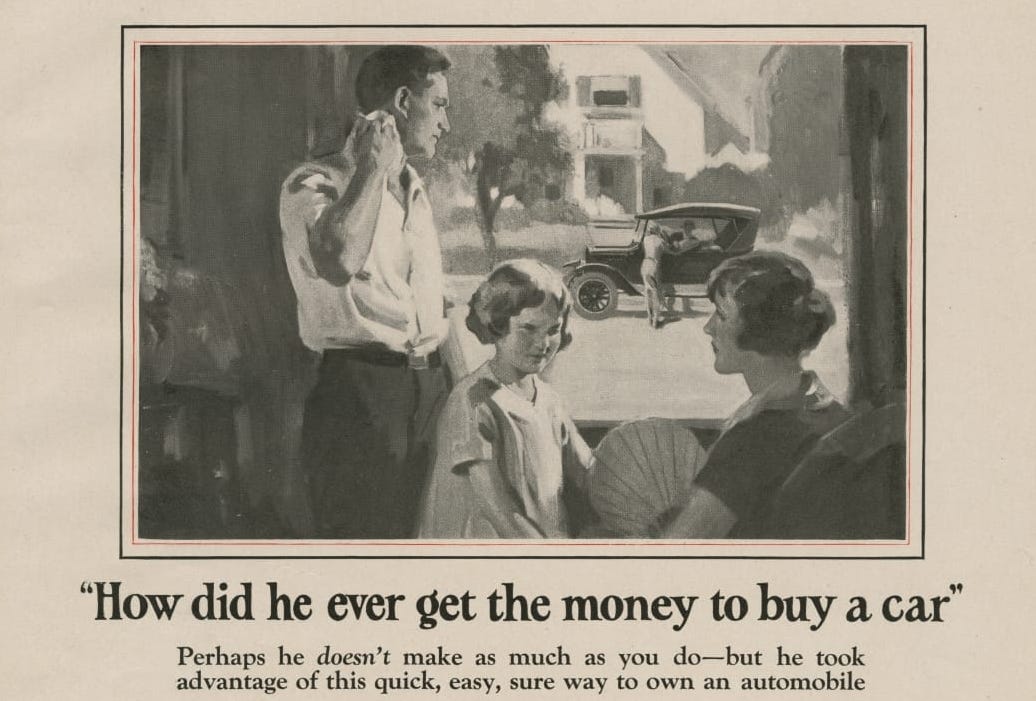

I love the early marketing (link to old magazine ad/.pdf):

"Why stay home on pleasant afternoons when you and the family should be enjoying nature's beauty outdoors?

You live but once and the years roll by quickly.

Why wait for tomorrow for the things that you rightfully should enjoy today?"

Yes, why wait? The catch was that the Ford Plan was more like layaway than real credit; you didn't actually take the car home until it was paid off. So, it wasn’t very successful.

But, competitors exploited the problem by offering solutions, and the automobile financing industry was born.

Skip ahead to 1938, we got Fannie Mae—the Federal National Mortgage Association (FNMA), which was originally a government-sponsored enterprise and part of FDR’s New Deal—and which opened up the mortgage market and staved off defaults.

Then in 1947, most of the big railroads combined efforts to issue the Rail Travel Card.

A couple of years later, a businessman named Frank X. McNamara forgot his wallet while out to dinner, turned his problem into a business idea, and launched the first restaurant charge card (Diner’s Club).

Then, in 1958, we got the first real “credit card,” meaning with revolving credit and a balance that didn’t have to be paid off in full each month.

The initial test market? Fresno. The reason why? Because it was issued by Bank of America, and 45% of Fresno residents were customers of BofA (which was a California-only bank at the time).

This meant BofA could (and did) simply mail 60,000 new “BankAmericard” credit cards to Fresno residents, no application required, and then target Fresno-area merchants to accept the card.

This solved a classic “chicken and egg” problem that would have been enormous otherwise. (Side note: The launch was actually kind of a disaster, with late payments and fraud running far beyond BofA’s initial projections. But, they stuck with it.)

What else should we throw in here?

In the 1960s we got the first plastic cards with magnetic stripes (thanks IBM!) …

In the 1970s we got the Fair Credit Reporting Act (thanks Congress!) …

In the 1980s we got the first frequent flyer programs (thanks American Airlines!), which, thanks to the credit card companies, developed into a multibillion dollar market.

And, in the 1990s we got Discover Card, which was mostly forgettable—except that it was my first credit card, and I immediately maxed it out ($1,000!) for a spring break trip to Panama City Beach, Florida that I think took me a year or two to pay off.

All right. So, why this trip down memory lane? Because on Monday, I think we might very well have learned about an important new chapter. It came during Apple’s Worldwide Developer Conference (WWDC), when Apple announced that it’s getting into the Buy Now/Pay Later business (which also gets a parenthetical abbreviation: “BNPL”).

In short, any consumer buying anything with ApplePay on their Apple device can set up a six-week installment plan, spreading the payments over four equal installments.

Apple isn’t the first-mover here—competitors like Klarna, Affirm, and Afterpay have a big head start, but they should probably be worried. Well, OK, worrying doesn’t actually solve anything—but Apple has a huge user base, and Apple doesn’t actually have to make any money from BNPL for it to be a success, so I would at least pay attention.

As Fortune reported:

“Apple’s interest in the sector goes far beyond immediate profits from BNPL, potentially giving the company an advantage over its fintech rivals … Apple is working to build a sprawling, in-house financial technology unit, with minimal reliance on outside partners.”

And while we're at it, as Bloomberg reported:

“The push would turn the company into a bigger force in financial services, building on a lineup that already includes an Apple-branded credit card, peer-to-peer payments, the Wallet app and a mechanism for merchants to accept credit cards from an iPhone."

Obviously I can’t predict for certain how a bold new consumer financial product that was literally introduced two days ago will actually shake out. But, it seems quite possible that this is the next step.

Seriously, why wait for tomorrow? Even just to write about it.

Folks, please lmk whether you can see the “7 other things” below. It’s so odd that it’s not appearing for people, and so far we have no idea why not. I’m trying something slightly different again today. Thanks.

7 other things worth knowing today

➨ CNN's new boss, Chris Licht, is evaluating whether personalities and programming that grew polarizing during the Trump era can adapt to the network's new priority to be less partisan. Why it matters: If talent cannot adjust to a less partisan tone and strategy, they could be ousted, three sources familiar with the matter tell Axios. (Axios)

➨ A looming Supreme Court decision on abortion, an increase of migrants at the U.S.-Mexico border and the midterm elections are potential triggers for extremist violence over the next six months, the Department of Homeland Security said Tuesday. The U.S. was in a “heightened threat environment” already, and these factors may worsen the situation, DHS said in the latest National Terrorism Advisory System bulletin. (AP)

➨ The ‘Yellowstone boom' -- meaning people attracted to Montana partially as a result of the success of the TV show -- is pitting lifelong state residents against wealthy newcomers. “We’ve had an influx of all sorts of wealthy individuals looking for ranches,” Robert Keith, founder of boutique investment firm Beartooth Group, told CNBC. “They’re looking to own really amazing large properties.” (CNBC)

➨ After several days of various Washington Post staffers dragging internal feuds into the public square of Twitter, Executive Editor Sally Buzbee sent a memo to Post staff admonishing them to “treat each other with respect and kindness.” And of course, because we live in the year 2022 and that sadly seems to be how things work, Buzbee’s missive spawned newly tweeted vitriolic spats. (Mediaite)

➨ A 58-year-old AT&T assistant VP who said he's been discriminated against for being an "old white guy" (his words) won a legal victory in his battle against the company. A federal judge in Atlanta refused to dismiss Joseph DiBenedetto's claim against the company that it refused to promote him as it "was vigorously trying to diversify [his] department’s workforce." (Reuters)

➨ I liked this a lot, by my colleague Jeff Haden at Inc.com. It's about how Slack learned to "sell the benefit, not the feature," and turn a messaging app into a $27 billion company. I think this is a lesson entrepreneurs often forget. (Inc.com)

➨ This time of year, fireflies normally light up the night sky in parts of Pennsylvania. But that glow is starting to dim, as firefly population numbers decline globally. One in three firefly species in North America may be at risk of extinction, according to a new study. That said, it's still OK to catch them in a jar, as long as you let them go afterward, said an expert. (WESA)

Thanks for reading. Photos: Fair use, and more fair use. Want to see all my mistakes? Click here.

Today I did open and read all 7 links to the various stories; mmm … I always associated meltdowns with young children (the WaPo tweets); am glad I’ve never been a Twitter user!

In my last job when working from home, Slack was almost the exclusive way by which we communicated with each other/ sought help with problems, etc. Great platform!

It’s so very very sad to see real estate rising so high as to be out of the average person’s affordability range; what’s even sadder is that landlords are doing the same - that’s just pure greed as I see it - in Montana and everywhere else.

If CNN (and all the other “news” networks) can get back to little to no partisan reporting, this country will be all the healthier for it. As an aside, it has to be a challenge due to the pressure/expectations of news 24/7 … how to fill all that space??

You missed the biggest step in credit card evolution. The gas station card. Esso, Shell, Mobile and more got cards into many wallets. Made them an acceptable item.